The first quarter market is coming to an end. Bitui terminal data shows that Ethereum has risen by 50.02% year-to-date (YTD), but Bitcoin has soared by 72.30%, and is expected to record its best quarterly performance in two years.

Ever since Ethereum began trading nearly eight years ago, its correlation with Bitcoin has been increasing. According to data from IntoTheBlock (ITB), in 2016 and 2017, the 100-day correlation between Bitcoin and Ethereum averaged 35% (where 100% means perfect correlation and -100% means perfect inverse correlation). That jumped to 66% in 2018, 77% in 2019, and then over 87% in 2022. As of press time, the price correlation between Ethereum and Bitcoin is currently 0.98, which is at a monthly high.

Ethereum performs better than Bitcoin in bull markets but underperforms in bear markets

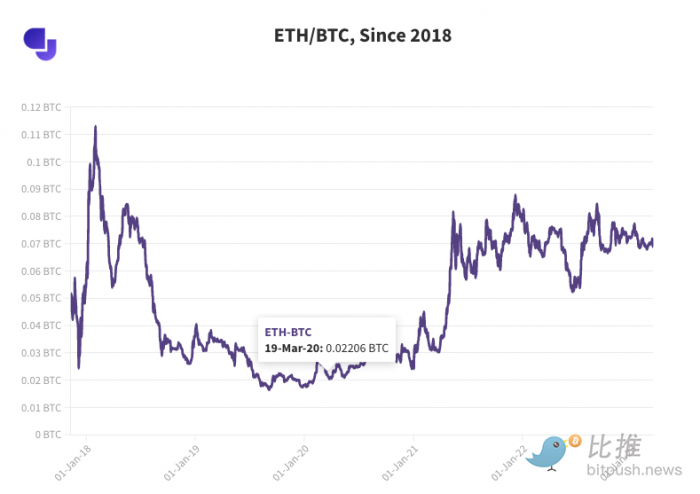

Over the past few years, especially during the Covid-19 crypto bull run of 2020 and 2021, Ethereum’s performance relative to Bitcoin has been crushing. Data posted by @DanniiAshmore shows that ETH/BTC has increased 2.53x since April 2020.

Therefore, like most altcoins, Ethereum tends to outperform Bitcoin in bull markets and underperform in bear markets. Because during periods of downturn in market sentiment, investors are more willing to bet on more "stable" investment targets rather than take risks and buy altcoins. After the implosion of projects like FTX , Celsius , LUNA and others, the crypto market may be shrinking altcoin positions due to too much fear and uncertainty.

Banking crisis strengthens BTC narrative

Market expectations for a U.S. Federal Reserve policy shift grew earlier this month after three U.S. banks collapsed and the Fed launched an emergency financing program to stem a banking panic. U.S. stocks and crypto markets were boosted by investor speculation that central banks led by the Federal Reserve would abandon aggressive interest rate hikes in response to recessionary signals.

Bitui terminal data shows that since the Silicon Valley Bank incident broke out on March 8, BTC has been outperforming ETH, which shows that BTC is still the preferred safe-haven asset for investors. Compared with other tokens, Bitcoin is a A better diversified investment tool.

As the number one altcoin, Ethereum has a completely different value proposition than Bitcoin. Bitcoin is a purely decentralized currency system that doubles as a store of value. While Ethereum has more and more use cases besides being a currency: digital collectibles, prediction markets, metaverse communities, and blockchain games, many members of the crypto community believe that Ethereum’s market value will eventually exceed that of Bitcoin.

As of press time, the difference in market capitalization between BTC and ETH is very large. ETH has a market capitalization of $214,376,317,596, and BTC is more than twice that of ETH, currently about $539,661,509,934.

Will Ethereum make a comeback?

Crypto trader KALEO (@CryptoKaleo) currently has a bearish stance on ETH/BTC, believing that ETH/BTC will continue to fall in the coming days. KALEO analysis said that BTC rebounded from the low of $19,528 on March 10 to the level of $22,000 and hit the 1.6 Fibonacci retracement level in March 2022, while ETH failed to reach a similar peak. Next, $32,000 to $33,000 is an important level that Bitcoin needs to break to continue its rise.

The “Exchange Reserves” indicator measures the total amount of tokens currently stored in all centralized exchange wallets . One of the main reasons why investors move their holdings to exchanges is for the purpose of selling, so this indicator rises. It could mean investors are reducing their holdings.

CryptoQuant analysts pointed out that investors have been depositing Bitcoin into exchanges, but this declined when the price fell below $20,000 earlier this month , indicating that there was some fresh buying near the lows. Much like Bitcoin, Ethereum exchange reserves plunged near local lows but have also been trending upward during the recent rally.

However, the rate of inflow is different. The inflow rate of BTC is very fast, and the total number of BTC inflows into the trading platform during this wave of gains exceeds the outflow amount at the trough, while the inflow rate of ETH is relatively gentle, far from reaching the level before the recent low. Analysts believe that this may indicate that Ethereum has not yet faced the same intensity of selling pressure as Bitcoin, and that ETH is still expected to continue its strong rise even after the BTC rally ends.

In addition, the Ethereum Shapella hard fork is expected to take effect on the mainnet in April. This change will allow validators who previously deposited 32 ETH to partially or fully unlock it. A potential 1.76 million ETH will flow into the market or be detrimental to the token price. . But from an optimistic point of view, there is a daily limit on the number of validators that can be unstaking, and users can also choose revenue mechanisms between decentralized finance ( DeFi ) applications such as Lido and Rocket Pool , so the Shapella upgrade may not necessarily causing selling pressure on the market.

Post time:2023-03-12