To many people, the cryptocurrency market may seem like an alien world with no real rules or reasons for how to trade.

However, just like traditional markets, cryptocurrencies go through their own cycles – and these price cycles are very consistent, including the timing between peak to trough, price recovery, and subsequent rally to new cycle highs.

We believe we are in the early stages of a new cycle. Using Bitcoin (BTC) as our benchmark, here is the typical structure of a cryptocurrency market cycle:

The price of Bitcoin hit an all-time high.

Subsequently, BTC suffered a painful retracement of around 80%.

Prices eventually bottomed out almost exactly a year after the previous cycle's high.

Bitcoin started to recover and it would take about two years to reach new all-time highs.

Bitcoin continues to rise for a year before hitting the next cycle high.

Then repeat the cycle.

The past few cycles have followed this playbook.

The consistency of these cycles is no coincidence. It is driven by stronger macro trends - which is also the core of Bitcoin's value proposition.

Bitcoin is not an inflation hedge as many people believe. Bitcoin is not a hedge against the Consumer Price Index (CPI). This is a hedge against currency devaluation.

This distinction is important because currency depreciation is driven by monetary inflation and the expansion of central bank balance sheets. Essentially, Bitcoin is one of the most leveraged bets in an expansionary liquidity environment.

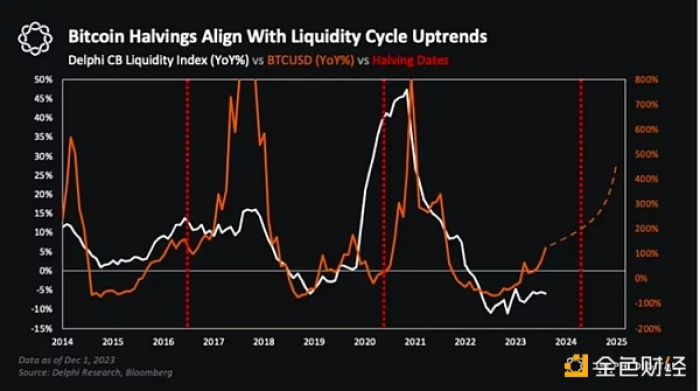

The Bitcoin halving is not the main catalyst for the Bitcoin bull run – the liquidity cycle uptrend is. As it happens, every halving is accompanied by an expansionary liquidity environment. The next halving is expected to occur in April 2024, which again looks to be just in time.

That’s not to say the halving isn’t important – it’s a powerful narrative that will certainly fuel a bullish uptrend, especially if we see a spot BTC ETF get early approval, as liquidity upcycles tend to accelerate funding flow.

BTC’s promising future

Bitcoin’s price bottomed in November 2022—almost exactly a year after the previous cycle’s peak. If BTC follows its historical strategy, this would mean a new all-time high by the fourth quarter of 2024, with the next cycle peak approximately a year later.

We noticed as early as the fourth quarter of 2022 that the downward trend in global liquidity last year seemed to have bottomed out, and the price bottom for Bitcoin has become history. The subsequent rebound in central bank liquidity has been a key support for the recovery in risk assets this year - especially cryptocurrencies.

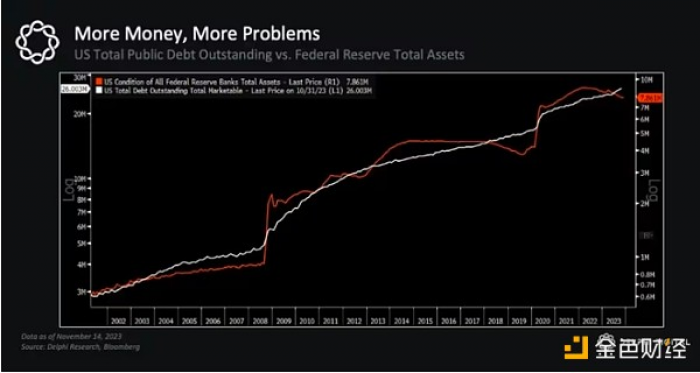

We expect these trends to continue. Looking ahead over the next 12 to 18 months, we expect central bank balance sheets to continue to expand - largely because they have to.

Many of the world's largest economies carry huge debt burdens, and in the United States, fiscal deficits are only expected to get worse (and that's without a recession). Larger deficits mean more debt issuance, which ultimately means more support from the Fed.

Unless the relationship in this chart, which shows total U.S. public debt versus total Fed assets, is completely decoupled.

If we are in the early stages of a new global liquidity uptrend, BTC and cryptoassets should significantly outperform over the next 12 to 18 months.

If we are in the early stages of a new global liquidity uptrend, BTC and cryptoassets should significantly outperform over the next 12 to 18 months.

Post time:2023-12-08