Bitcoin prices continued to rise in November, with the cryptocurrency recovery extending to broader market segments.

Financial markets have softened on certain macro risks, including geopolitical conflicts in the Middle East and the risk of a "hard landing" for the U.S. economy.

The combination of “tight” token supply, easing macro risks, and the focus on excessive government borrowing that the U.S. presidential election will bring could be beneficial to Bitcoin valuations in 2024.

After losing ground in 2022, Bitcoin rebounded 130% in 2023 and is on track to become one of the best-performing major assets of the year. The cryptocurrency recovery continued in November as financial markets eased on various macro risks. In the digital asset market, this has resulted in a shift in market leadership away from Bitcoin and towards an increasingly broad segment of the crypto market. Grayscale Research believes that cryptocurrency fundamentals are gradually improving and the supply situation of major coins is relatively tight (for example, due to Bitcoin’s current ownership structure). This could be consistent with rising cryptocurrency valuations in the coming year, especially if the Fed completes tightening and the U.S. economy can avoid a "hard landing" (recession).

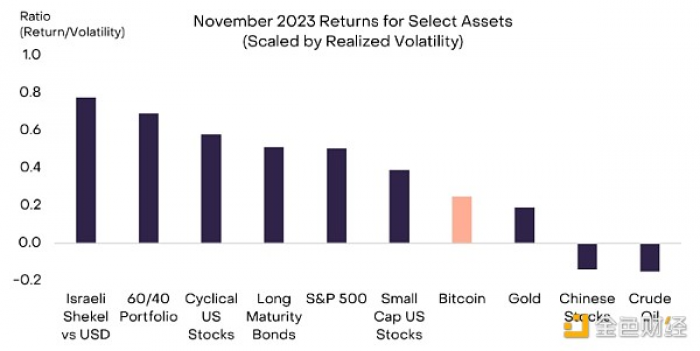

Over the last month, financial markets appeared to have relaxed somewhat on various tail risks, which helped previously underperforming assets rebound. For example, positive signs from the conflict in the Middle East appear to have reduced concerns about broader regional chaos, and assets tied to the Israeli economy have rebounded as a result (Chart 1). Likewise, long-term Treasury bond prices rose (yields fell) after the Treasury Department announced a smaller-than-expected increase in borrowing demand. Consumer price inflation also continues to decline, raising hopes for an eventual rate cut by the Federal Reserve and a potential "soft landing" for the U.S. economy. On a volatility-adjusted basis, Bitcoin has underperformed this month (it has outperformed since late August) but still managed a 9% gain (Ethereum gained 13% in November).

Chart 1: Reduced tail risks drive asset market recovery in November

Broader Cryptocurrency Recovery

Until recently, Bitcoin has been outperforming other crypto assets due to demand for it as a digital alternative to gold and optimism over the approval of a spot Bitcoin ETF. However, the cryptocurrency market leadership changed in November as the rally expanded beyond Bitcoin.

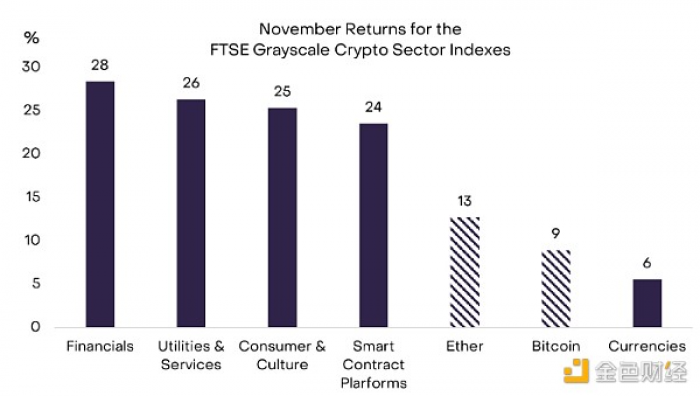

According to the FTSE Grayscale Crypto Industry Index Series, the best-performing segments last month were Financial Crypto, Utilities and Services Crypto, and Consumer and Culture Crypto (Exhibit 2). Thorchain's RUNE token surged 131%, lending support to financial crypto industry indices; the protocol runs decentralized exchange ThorSwap, which has seen an increase in trading activity recently. For the consumer and cultural cryptocurrency space, November gains reflected growth in gaming-related tokens ImmutableX and Illvium. Illuvium (up 119%) launched its namesake game on the Epic Games Store on November 28, while ImmutableX (up 87%), a layer 2 blockchain for crypto gaming applications on Ethereum, announced a partnership with Ubisoft .

Chart 2: Financial, consumer and cultural cryptocurrency sectors outperformed the market

In addition to the latest price dynamics, the market has renewed its focus on the intersection between cryptocurrencies and artificial intelligence (AI) technology following leadership turmoil at OpenAI. We believe there may be synergies between public blockchain and artificial intelligence technologies. Specifically, blockchain can combat or address potential social risks posed by artificial intelligence, such as deepfakes, bots, and the proliferation of misinformation. Additionally, decentralized computing protocols can combat centralized control of powerful AI models that hold sensitive personal information (see our background report, The Convergence between AI and Cryptocurrency, for more details). Major crypto projects that Grayscale Research considers relevant to the AI topic include Akash and Render (GPU sharing), Worldcoin (identity), and Bittensor (open architecture AI development).

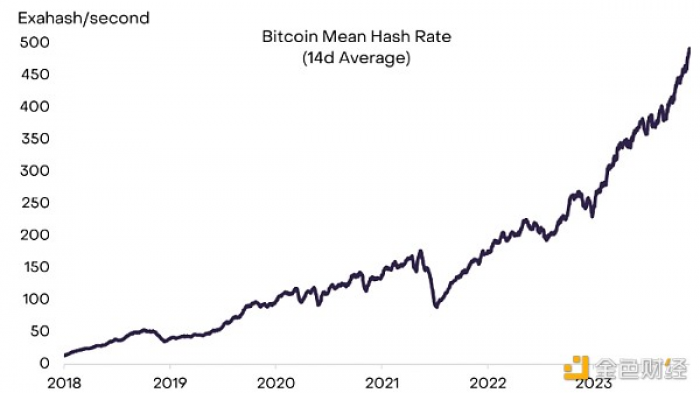

As valuations rise, fundamentals across a range of cryptocurrency sectors also improve. For example, Bitcoin’s hash rate, a measure of the amount of computing power required to secure the network, reached an all-time high in November (Chart 3). We attribute this trend to miner upgrades ahead of next year’s Bitcoin halving, rising token prices (which make older machines profitable), and an oversupply of relatively new machines operated by mining equipment manufacturers. We will also consider increased stablecoin activity as a reason for improving cryptocurrency fundamentals. Last month, the total market value of stablecoins increased by $4 billion, and the amount of Gas used in stablecoin transactions also increased.

Chart 3: Bitcoin hash rate hits all-time high

Fundamentals Driving Bitcoin Price

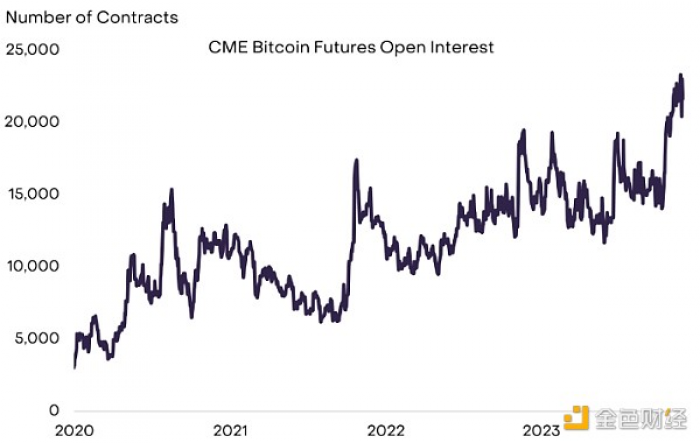

Following a period of significant gains, we now describe active cryptocurrency traders’ positions as relatively “long.” For example, open interest in CME-listed Bitcoin futures reached a record high in November, which may indicate increasing institutional activity in the market (Chart 4). Meanwhile, cryptocurrency exchange-traded products (ETPs) — which include futures products in the U.S. and spot products overseas — attracted another month of net inflows. Grayscale research estimates that global net cryptocurrency ETP inflows totaled $1.3 billion in November, bringing the full year to $2.2 billion.

Chart 4: CME Bitcoin futures open interest hits record high

In terms of the short-term market outlook, “long” trader positions mean it may be harder for prices to rise further. Major crypto token prices have appreciated significantly and now reflect a more positive outlook. Additionally, the outlook carries risks that could derail this year's positive trends. These include a "hard landing" (recession) of the U.S. economy, a resumption of rate hikes by the Federal Reserve or a lower-than-expected Fed rate cut, or a lengthy delay in U.S. market regulators approving a spot Bitcoin ETF. Each of these risks could hinder the cryptocurrency's recovery, at least in the short term.

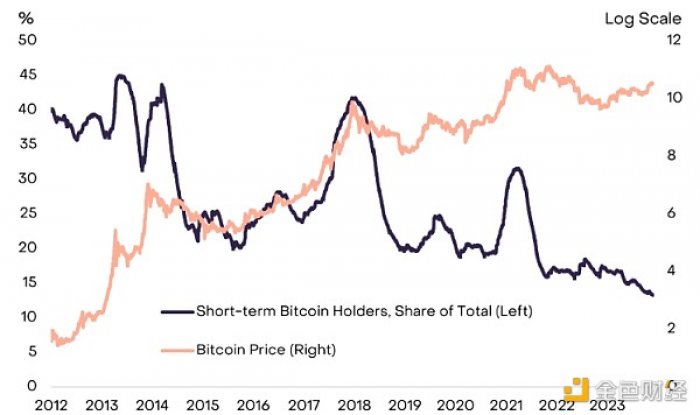

That being said, we believe the core situation in financial markets and the economy is likely to be positive for Bitcoin and other cryptoassets. Before potential investors flowed into U.S. spot ETF products, the supply of Bitcoin was relatively "tight." For example, the share of Bitcoin supply held by short-term speculators has reached an all-time low, according to Glassnode data (Chart 5). Likewise, Grayscale Research's analysis also shows that a significant portion of Bitcoin is held by entities that may be slow to sell into appreciating markets (see Demystifying Bitcoin's Ownership Landscape for more details). Next year’s Bitcoin halving will also limit the growth of new coin supply. We believe the combination of inelastic Bitcoin supply and potential new investor inflows should have a positive impact on valuations.

Chart 5: Long-term holders hold a larger share of Bitcoin supply

More important than the technical background , however, is Bitcoin's fundamental outlook. Bitcoin is a macro asset that many consider a digital alternative to physical gold. As such, its price may be affected by factors driving demand for digital gold, including Federal Reserve monetary policy, the health of the U.S. economy, and the soundness of the fiat currency system. The market reaction to the election of Javier Milai is just the latest example of the impact such factors can have. Despite uncertainty about the macro outlook, economists unanimously expect the Federal Reserve to cut interest rates next year and the U.S. economy to avoid recession. There will also be a U.S. presidential election next year, which we expect will focus on excessive government borrowing, the independence of the Federal Reserve, and other issues affecting the long-term value of the U.S. dollar. Grayscale Research expects this combination to have a positive impact on demand for physical and digital gold and could be consistent with rising Bitcoin valuations.

Post time:2023-10-11